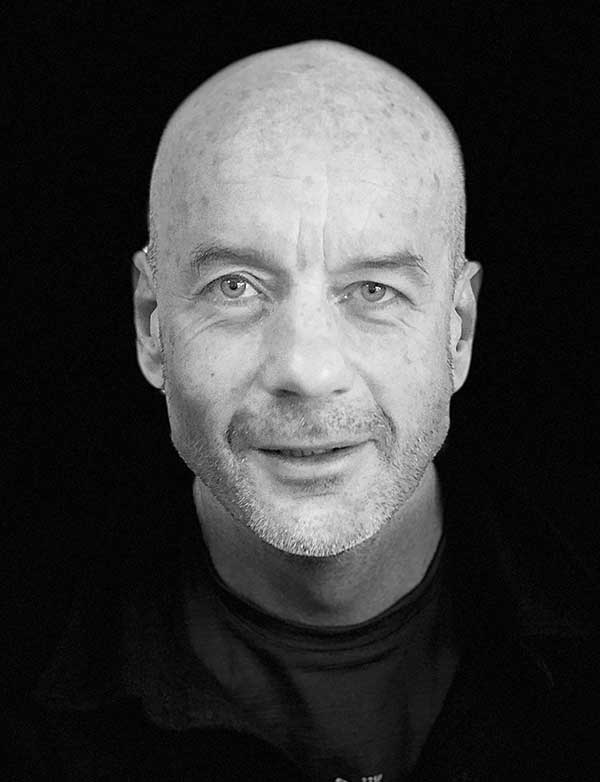

Thomas Wehlen Founder and Senior Fund Manager

Thomas is the Founding Partner and Chief Investment Officer for Coburn Barrett. As company founder and Chief Investment Officer for the GLI fund, he is the principal architect of the fund’s quantitative methodology.

In 1994 Thomas joined Union Bank of Switzerland where he was Risk Manager on the Funding Desk, managing both buy and sell sides of a balance sheet for a USD $200 billion enterprise and developing a new model for measuring risks of the balance sheet that employed trader tools. Prior to that he interned at Goldman Sachs, London, on the Proprietary Trading desk where he devised proprietary trading strategies for fixed income instruments.

It was at Goldman Sachs where his investment strategy was born and after being awarded special recognition for the highest profits earned by a summer associate, Thomas continued to develop what would later be known as Global Leveraged Indexing (GLI), which since inception has risen in value 15-fold, and outperformed more than 99% of all funds.

In 1989, Thomas founded and owned his own business services consulting firm where he was involved in development of a non- linear trading model (which piqued his interest in finance) and served as technical adviser to banking and insurance clients including Credit Suisse and Dow Chemical.

Thomas has an MBA from the University of California Berkeley, an M.S. in Computer Engineering from the Swiss Federal Institute of Technology, and a Matura in Mathematical Core from Institut Montana Zugerberg. Away from quantitative methodology, Thomas greatly enjoys back country skiing, swimming in the San Francisco Bay, sailing regattas with Rainer Genschel, squash and distinctly mediocre golf and tennis. He would like to work from a café if possible where he is best known for his arm chair philosophizing.

Q&A

In the very first finance class at business school, my class was shown statistical evidence of efficient markets and the benefits of diversification. Then I got a trading internship at Goldman Sachs, and was told: “This trading floor is a temple to inefficient markets”. This dichotomy intrigued me.

At the same time, passive funds were gaining recognition because active funds were charging more, and yet underperforming the index. Finally, I learned that options are priced using models that rely on statistical random walks. And their pricing works- they end up close to where they should be. The option pricing model is pretty good; and it tells you the future is random.

So you have stock traders and fund managers who try to predict the future price movements of assets, and option traders who rely on the fact that prices cannot be predicted- the same dichotomy.

Options pricing models are proof that markets are pretty efficient. This does not necessarily mean that asset prices are correct, just that they are the best guesses and cannot be beaten consistently. Active managers effectively think or pretend they can beat the options pricing model.

While at UBS, I analyzed 18 months of trading history on my trading floor, separating out every trade done by the bank for its own book. I inspected hundreds of thousands of trades. Over that period, trades done for the bank’s own book lost exactly the trading costs. i.e. the spread and brokerage fees. This effectively meant that the securities could have been randomly chosen with the same result.

I argued trading desks could make more money if they didn’t trade so frequently. However, trading departments and brokers had what they believed to be a mutually beneficial relationship. Many risk-managers traded simply for the sake of trading, while allowing their views to flip/flop constantly. The strangest things would impact their decisions. One trader told me that if he didn’t know which view to take that day, he would go long $/DM if the left elevator came first, but if the right came first, he would go short.

I don’t think shareholders know that their money is occasionally being invested on the basis of which elevator door opens first.

There had to be an opportunity in this irrational behavior. When we fired up our own fund, we made only two basic assumptions: that global GDP would continue to grow and that diversification works.

Financial theory says something quite radical, i.e. that the only real investment decision an investor faces is how much risk to take. So we started from that vantage point. For the fund, we chose the level of risk of an S&P 500 index fund because we felt that would be familiar to people. We then back tested and simulated a model of our fund at an annualized, daily standard deviation of 16%.

To carry out a proper back test, you can’t look at history in the order events as they happen. Because it is a random walk; you have to do it over and over again, in a different order. In this process, we predicted we could achieve excess returns of at least 400 basis points per year; and If you look at the last 20 years, this has turned out to be the case. Our model turned out to be right: The S&P 500 has produced a total return of 7.2% a year in nearly twenty years, and we have produced 14.8%.

During the first four years, our performance was disappointing due to an underweight position in money market securities after the tech bubble burst. We had not considered the duration of their returns. We had actually bought three-month securities, but we needed to invest ten times more. In order to get protection, we realized you needed to buy the entire five year strip. We readjusted our model and our performance improved.

Our worst years were: 2001 when we lost 27.6%, 2008, when we lost 13.9%; and 2015 when we also lost 13.3%. I’ll discuss each year in order. I should preface this by saying they are very simplistic explanations for a rather complex model.

As I said in the previous question, in 2001, we were underweight in the short end of the yield curve. Our losses were in line with stock market returns, but exposed a flaw in our model.

In 2008, we felt the overall result was good considering the circumstances. We did over-ride the model by over weighting money market securities and adding volatility securities.

In 2015, we were hurt by the collapse of the commodities market; but commodities are an essential part of our diversification strategy. They have helped us more than they have hurt us over the years.

We charge a flat 2% fee, because contrary to popular opinion, performance fees are a terrible incentive for the hedge fund manager. A performance fee is in effect a call option on the future return of the fund. The value of an option is primarily dependent on the risk of the underlying. Unsurprisingly, managers take on as much risk as possible, because that makes their option more valuable. When markets fall, the customer takes the loss. Hedge fund managers often open three or four different funds, using long or short bias strategies. The firm is guaranteed to make money, no matter what the market does.

Most hedge funds (approximately 70%) have a lifespan of three or four years. Our intention, above all else, is long-term, inter-generational survival. As someone said in 1916 in an advertisement for the Security Investment Company: “Gentlemen, if the man who invented compound interest had secured a patent on his idea, he would have had without any doubt the greatest invention the world has ever produced.”

Serious money is only made when one can invest a large portion of one’s total wealth over the long-term. It is of no use to get a spectacular one year return on an investment that is so risky, one can only invest a tiny portion of one’s portfolio.

We would obviously like to raise more money, but our focus lies in asset management. Perhaps naively at the outset, we believed that the money would immediately flow in with good returns; that people would do their research and call us up. Time will tell.